Accounting is the recording, tracking, and reporting of your financial transactions and accounts. Keeping accurate financial records is very important to help understand the financial health of your business. Having your financials up to date will also make completing your federal, state/provincial, and local taxes easier.

Overall, your accounting can be summarized using the ‘Accounting Equation’: Assets – Liabilities = Owner’s Equity.

Assets are the things your company owns (cash, accounts receivables, inventory, property, and equipment). Liabilities are the amounts you owe against your assets (accounts payable, accrued sales and income taxes, and other debts). Owner’s equity is a company’s value, or net worth, expressed as the difference between its assets and liabilities.

Double-Entry Accounting

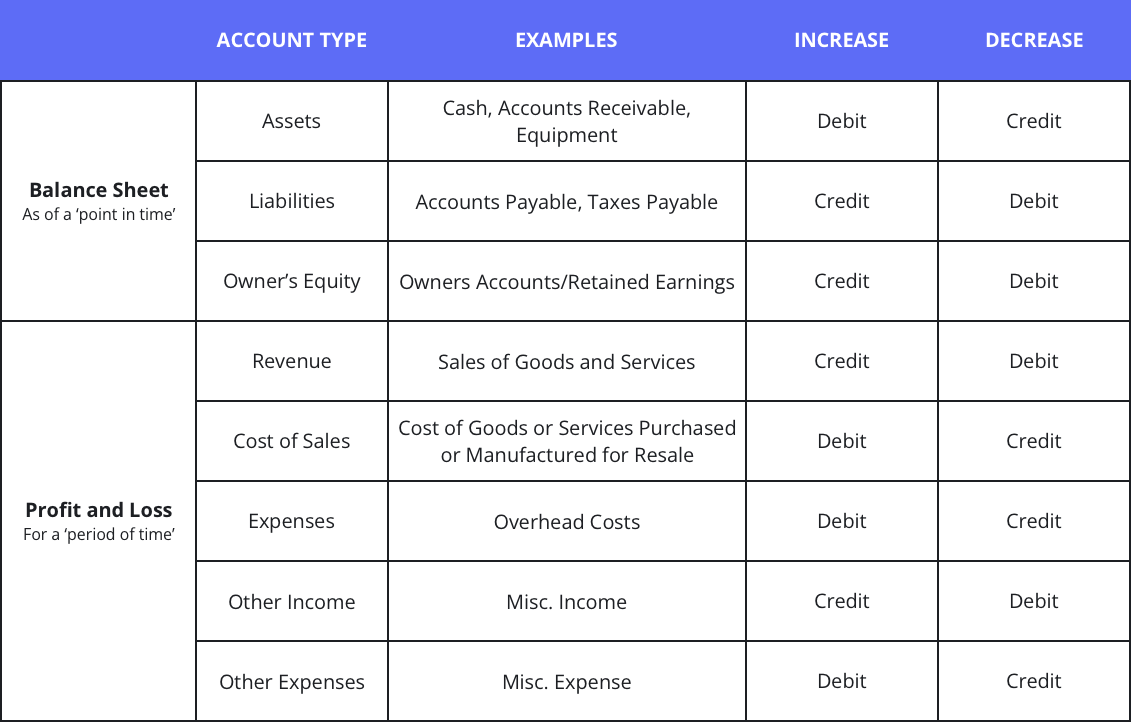

Double-entry accounting means that every transaction has at least one debit and at least one corresponding credit. The total debits will always equal the total credits for each transaction. A true double-entry accounting software, like AccountEdge, would alert you if you tried to record an unbalanced transaction.

Every transaction affects at least two accounts on your chart of accounts in the form of debits and credits. Every transaction must be recorded so the total debits equal the total credits. Double-entry accounting ensures each transaction is recorded in two places to maintain balance. For example, if you spend $500 on a laptop for the office, your cash on hand will decrease by $500, but your fixed assets (which you’ll then depreciate) will increase in value by $500.

Chart of Accounts

Your Chart of Accounts is a list of all the accounts you will use to track your business transactions.

Let’s drill down on how each account type relates to your small business.

Assets

An asset is anything you own in your business. They are the things in your office, your computers, scanners, hard drives, vehicles, your receivables owed by customers, your inventory and your cash on hand. Everything you own is considered an asset of the business. Assets are used to generate revenue and purchase other assets. For example, when you buy a new computer, you use one asset (cash) in exchange for another asset (computer equipment).

There are short-term assets, which are things that can be turned into cash quickly, like receivables and long term assets, for example, property and equipment.

Liabilities

Your liabilities are the things you owe, like sales taxes received from sales but not yet paid to the state or loans payable to your bank. Another example is your credit cards – unless you pay your balance off every month, the money you owe to your credit card company is considered a liability on your books. Liabilities represent claims against your assets.

There are short-term liabilities for debts that will be paid in the short term, like payables, and long term liabilities like loans other structured debts.

Owner’s Equity

The difference between the value of your assets and the total of your liabilities is the value of your company. As the Accounting Equation states, Assets – Liabilities = Owner’s Equity. Depending on the type of taxable entity you created when you first formed your company, the Owner’s Equity section of your Chart of Accounts and Balance Sheet may have another name.

Revenue

Your company’s revenue is the total amount of proceeds generated from providing goods and services to your customers. This is typically the total amount of the invoices you generate for your customers.

Cost of Sales

Cost of Sales (or COGS) refers to the total value of the goods and services sold to customers. Typically, this refers to items-based businesses that buy inventory for resale or a manufacturer who builds items for resale. Total revenue minus the cost of goods sold equals your gross profit.

Expenses

Expenses are the costs you incur to run your business, whether fixed costs (independent of how much business activity you have, like rent) or variable costs (directly related to how much business activity you have, like shipping).

Debits and Credits

In double-entry accounting, every transaction is recorded or posted to your chart of accounts in the form of debits and credits. The total debits for a transaction always equal the total credits for the same transaction. Increases do not necessarily equal decreases.

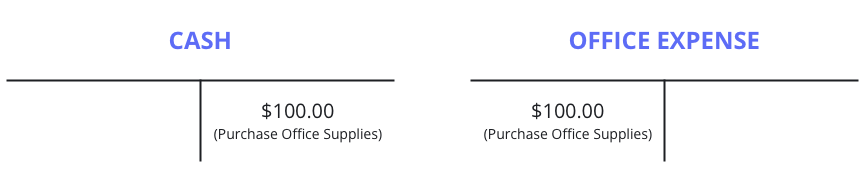

T-Accounts are a graphical representation in the form of a ‘T’ showing debits (on the left) and credits (on the right) in a specific general ledger account.

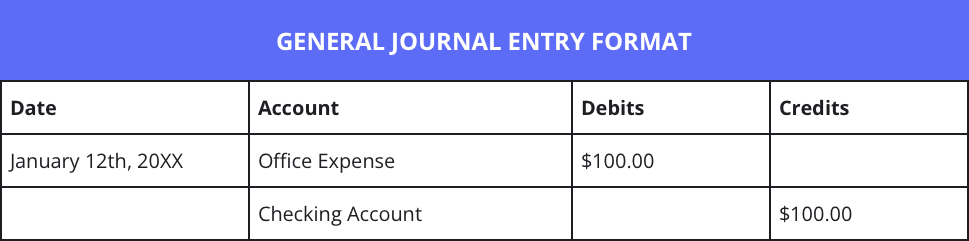

A simple example is the purchase of office supplies. As a transaction, you are buying office supplies and paying with cash. Therefore, you are debiting the amount of the supplies to your “Expense” account and crediting your “Cash” account.

Your transaction entry in your general ledger.

The Golden Rules of Accounting

Let’s discuss the Golden Rules of Accounting.

- Debit the receiver and credit the giver

An example is when you have to pay rent for your office location. You will debit your expense account for rent and credit your asset account for cash. - Debit what comes in and credit what goes out

An example is when you need to purchase a new office computer. You will debit the cost of the computer to an asset account (to be depreciated, otherwise an expense account) and credit your cash or bank account. - Debit expenses and losses, credit income and gains

An example is if you receive a payment from a customer. You will debit the payment to your cash or bank account and credit your revenue account.

Key Takeaways

- Accurate accounting is essential for tracking a business’s financial health and ensuring accurate tax reporting. Keeping financial records up to date helps in managing federal, state/provincial, and local tax obligations.

- Every transaction affects at least two accounts, with total debits always equaling total credits. This method ensures balanced records and helps identify potential errors in financial transactions.

- The three golden rules—debit the receiver and credit the giver, debit what comes in and credit what goes out, and debit expenses and losses, credit income and gains—govern how transactions are recorded in accounting to maintain accuracy and consistency.

AccountEdge Makes This Easy

AccountEdge can help small businesses save time, improve accuracy, and provide more insights into your business with detailed reporting. With all the features you need to get started today, AccountEdge makes accounting easy.