For small business owners, tracking the right financial metrics is crucial for staying on top of operations, improving profitability, and maintaining healthy cash flow. By utilizing these reports, small business owners can make informed decisions, improve cash flow management, reduce risks, and plan effectively for future growth. Here are some key business accounting reports that can help small business owners manage their finances effectively:

Financial Statements

Good business management starts by analyzing, interpreting and acting on the results of periodic financial statements. Taken as a whole, they give you a complete picture of your business at a point in time. These should be run monthly, quarterly and annually and compared to previous periods to tell the story of your business, from your assets and liabilities to your sales and expenses.

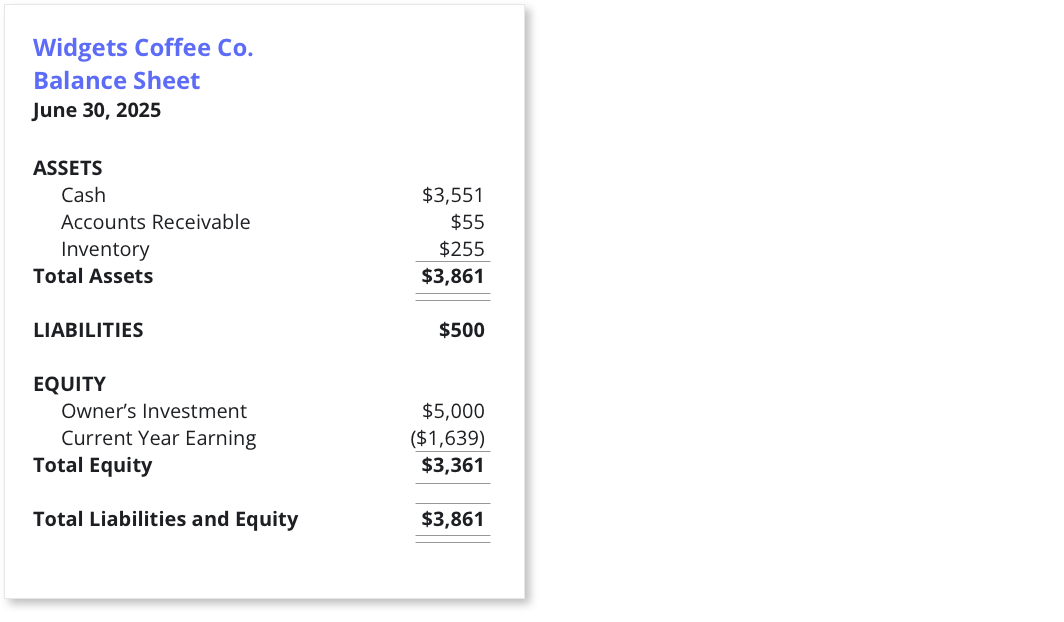

Balance Sheet

Provides a snapshot of a company’s financial position as of a specific point in time, listing assets, liabilities, and owner’s equity. Showing what the business owns (assets), owes (liabilities), and its net worth (equity).

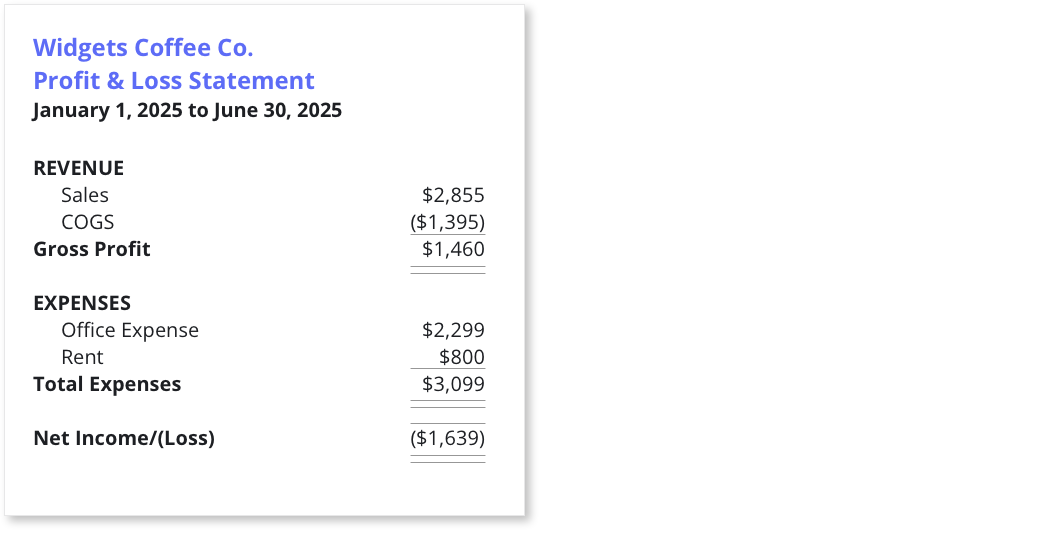

Income Statement (Profit and Loss Statement)

Summarizes the company’s revenues, costs, and expenses over a specific period (e.g., monthly, quarterly, or annually). It shows whether the business is making a profit or incurring a loss.

Cash Flow Statement

Tracks the cash flow in and out of the business, divided into operating, investing, and financing activities. This helps ensure that the business has enough cash to cover its obligations.

Accounting Reports

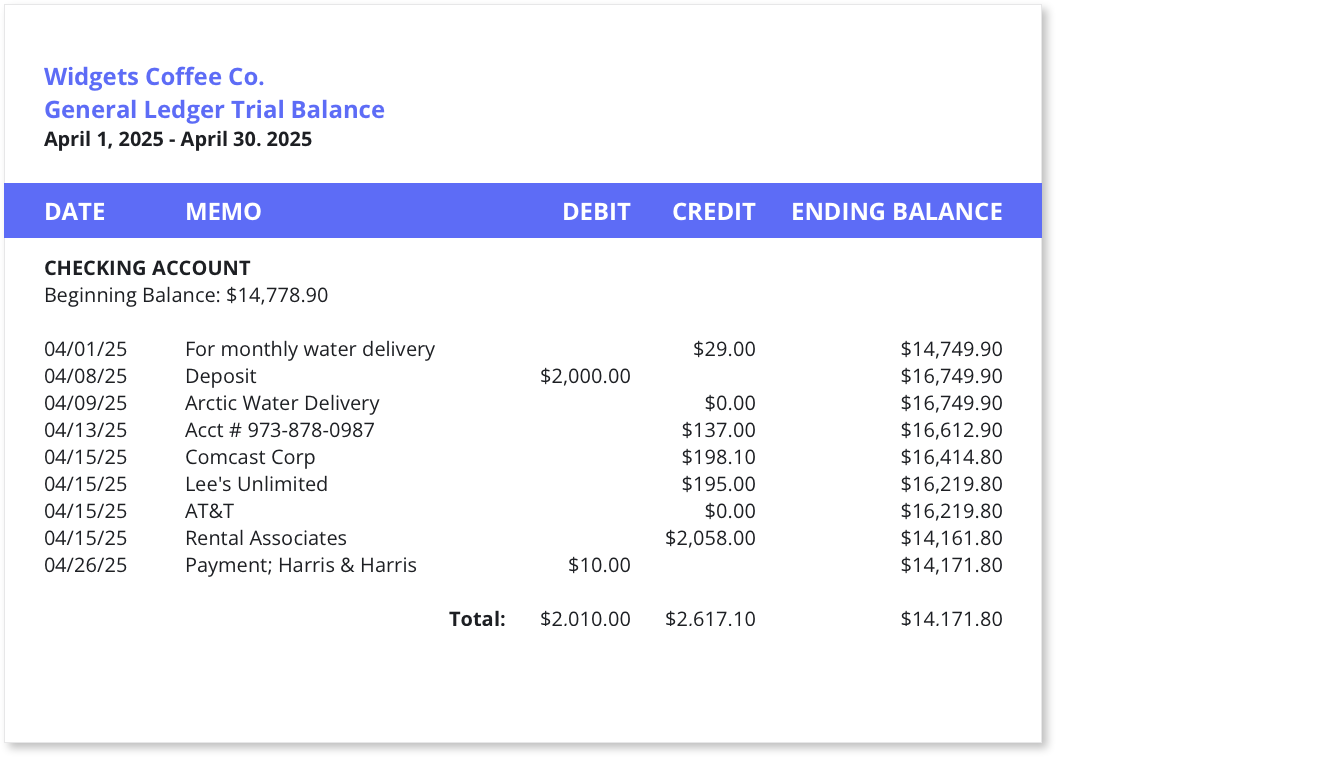

General Ledger Trial Balance

A detailed record of all financial transactions over a specific period, categorized by account. Providing a comprehensive overview of all financial activity is essential for reconciling other reports.

The trial balance report provides the most comprehensive transaction detail per general ledger account for the specified period. While it may not be as user-friendly as other, more formatted reports, it offers detailed transaction information that supports all other reports generated by your accounting system.

Profit and Loss by Job or Department

Shows the profitability of different business segments, departments, or individual jobs. Helps business owners identify which areas are most profitable and which need attention.

A business that is job or department-centric needs to know how each area is performing. Run this report along with your standard Profit and Loss and use it to manage business segment operations. Capturing as much detailed revenue and expense information at the transaction level will help you analyze these segments in the most detail possible and aid in decision-making and budget development.

Financial Ratios Report

Provides key financial ratios to assess the financial health of the business. This information helps owners make data-driven decisions based on financial trends and comparisons to industry benchmarks.

There are a number of financial ratios that should be used to analyze a business over time. Your accounting system will make tracking these ratios easier, here are a few examples:

- Gross Profit Margin Ratios – to assess if sales revenue is covering your expenses

- The Current Ratio – compares current assets to current liabilities

- Profit Margins Ratio – measures the amount of net income earned with each dollar of sales

- The Quick Ratio – used to measure a company’s liquidity

- Recevables Turnover Ratio – a measure of efficiency and cash flow to determine how often your account receivable are collected

- Inventory Turnover Ratios – determines how often your inventory is sold and replaced over time

Equity Statement

Shows the changes in the company’s equity over time, including retained earnings, new investments, and distributions. Providing a deeper understanding of ownership structure and profit retention.

Managing sources and uses of equity can hklep your business plan, especially for future capital intensive projects and investments. If you have a team of investors, they will be keenly interested in how their funds are being used.

Cash Flow Forecast

Predicts future cash inflows and outflows based on historical data and expected events. This helps in planning for potential cash shortages or surpluses.

Although this report is based on expectations, it is a good barometer of cash flow based on normal customer patterns and can help you manage money coming in to cover future debt and payroll.

Budget vs. Actual Reports

Compares the business’s actual financial performance with the budgeted amounts. This will identify variances and allow for better future forecasting, planning and adjustments.

Creating a budget is the sign of a smart owner/manager, so running a report that compares actual dollars to budget expectations will help you fine tune your future budgets and manage performance over a period of time.

Customer & Vendor Reports

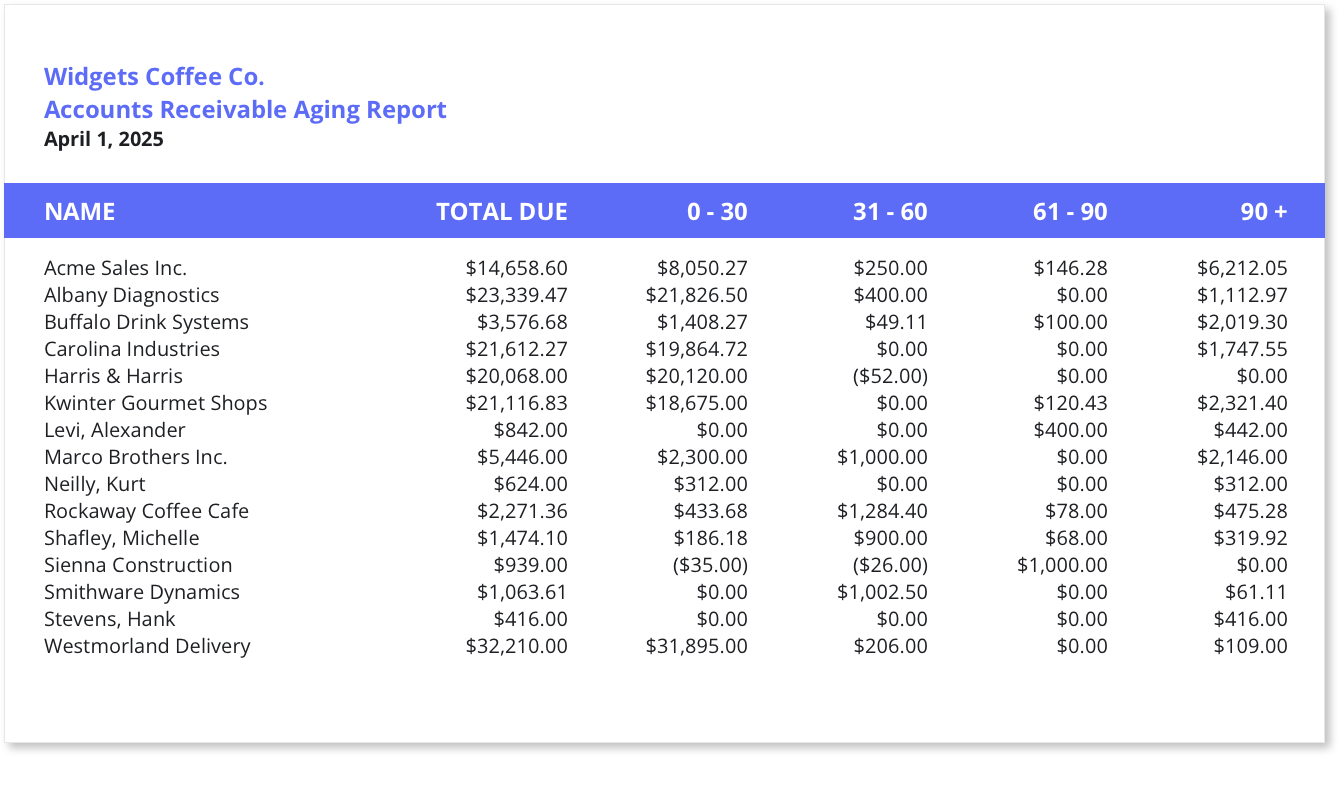

Aging reports are critical to help you manage cash flow, stay on top of customer receivables and manage bill payment. They should be run monthly, with detailed analysis of both customer and vendors. Special attention should be given to customer balances, with follow up processes in place to contact those who are over 90-days old.

A laser focus on customer related reporting is a critical step in meeting customer needs and making sure you have quality relationships.

Accounts Receivable Aging Report

Breaks down outstanding customer invoices by due date (e.g., 30, 60, 90 days), helping to identify overdue customer payments and assess the efficiency of your collections process.

Accounts Payable Aging Report

This report is similar to the accounts receivable aging report, but it is for money the business owes to vendors and creditors. It provides insight into overdue payables and helps manage cash flow.

Customer Retention Report

This report would analyze how well a company is able to retain its existing customers and prevent them from leaving for other providers. It is a good measurement of customer loyalty to your brand and products and services.

Customer Profitability Report

Analyzes the profitability of individual customers by comparing sales revenue with COGS. This will identify the most valuable customers and guide decisions on pricing and service offerings.

Vendor Payment Report

Tracks payments made to vendors for goods and services, accurately tracking outstanding obligations and helping manage vendor relationships.

Payroll Reports

Whether you run payroll internally or use a service or web app, keeping on top of employee pay is a critical component of keeping your employees happy. In addition, keeping on top of taxes owed, tax form submissions and other compliance details is an important part of managing your employees and your business.

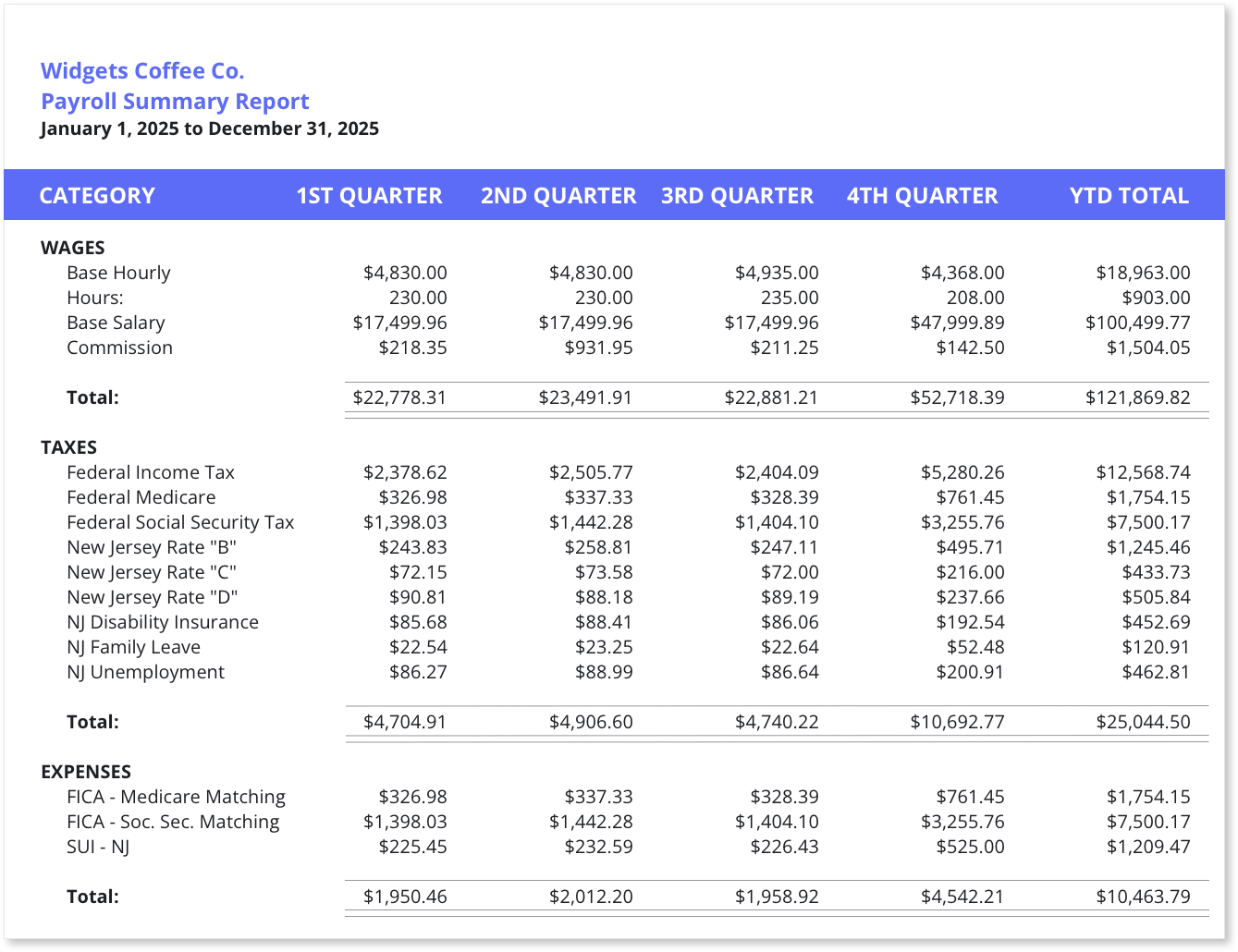

Payroll Summary Report

Provides an overview of all payroll wages, taxes, deductions, accruals, and employer expenses. It ensures accurate payroll processing and compliance with tax regulations.

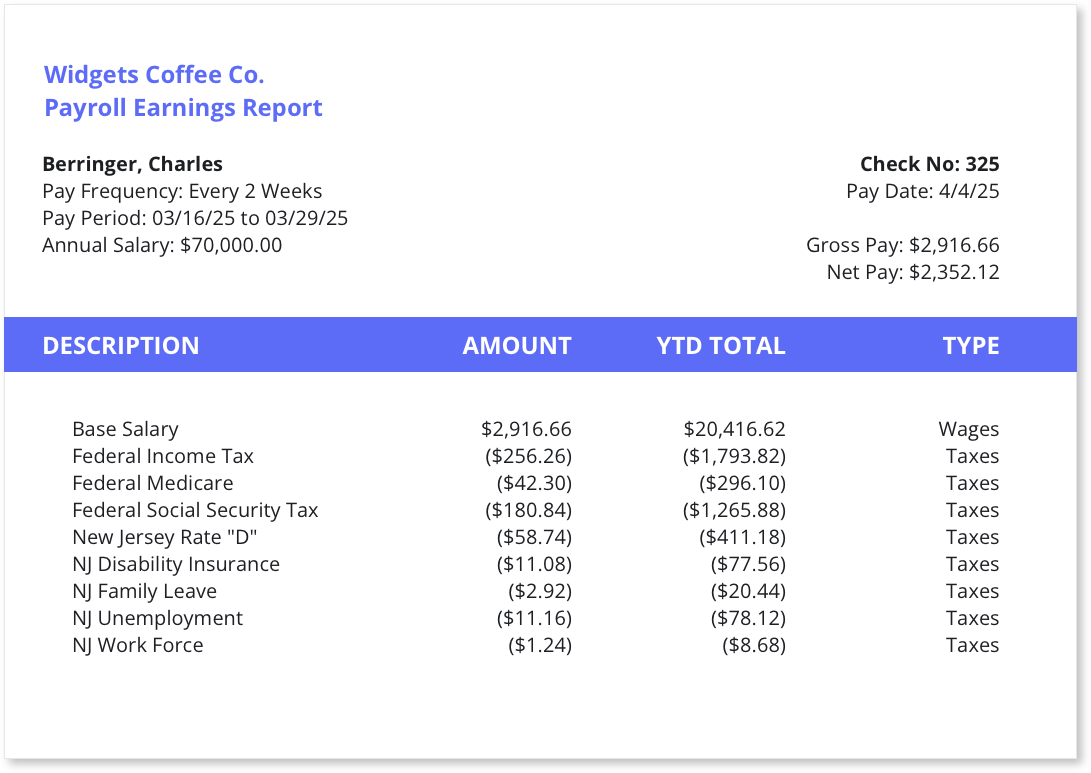

Payroll Earnings Report

Provides details of all paychecks for each employee.

940/941/RL-1/T4

Provides information required to fill out the Federal (FUTA) 940 and 941 returns for the US and Canadian RL-1 and the T4 summary forms.

Tax Liability Report

Summarizes the business’s payroll tax liabilities to ensure the business is on track to meet its tax obligations and avoid penalties.

Other Reports

Bank Reconciliation Report

Compares the company’s bank statement with its general ledger to identify uncleared checks and deposits. This ensures the accuracy of the business’s financial records and avoids errors or fraud.

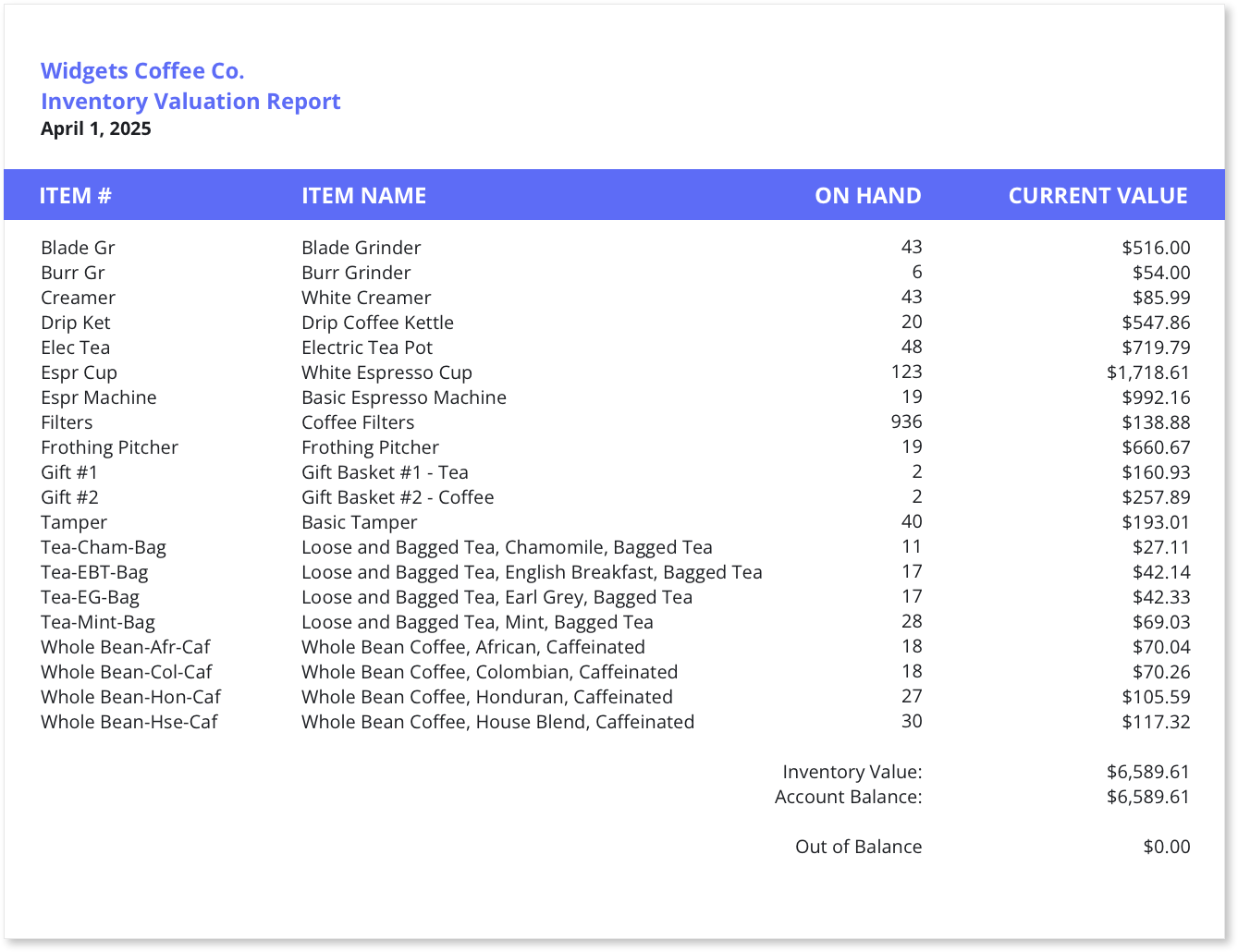

Inventory Valuation Report

Provides details on the value of the company’s inventory on-hand in quantity and dollars. This information helps to track inventory levels and calculate the cost of goods sold (COGS), which is essential for profitability analysis.

Break-even Analysis Report

Identifies the point at which the business’s total revenues equal its total costs, indicating no profit or loss. Helping determine how much sales the business needs to cover all its expenses.

Sales Tax Liability Report

Tracks the sales tax collected and payable to state and provincial tax authorities. This ensures accurate sales tax reporting and prevents underpayment or penalties.

Job Costing Report

Tracks costs associated with specific jobs or projects, including labor, materials, and overhead expenses. Assessing the profitability of individual jobs or projects.

Key Takeaways

-

Regularly monitoring financial reports helps small business owners understand their financial health and identify areas for improvement.

-

Reports like the cash flow statement and bank reconciliation ensure smooth financial operations and prevent cash shortages.

-

Reports like the profit and loss statement, job costing, and customer profitability help businesses focus on high-margin areas.

Powerful Reporting with a Click

Using AccountEdge to manage your financials makes it even easier to view, print, export, and customize hundreds of reports to your unique needs. Integration with Power BI allows you to visualize your data with custom tables and charts.